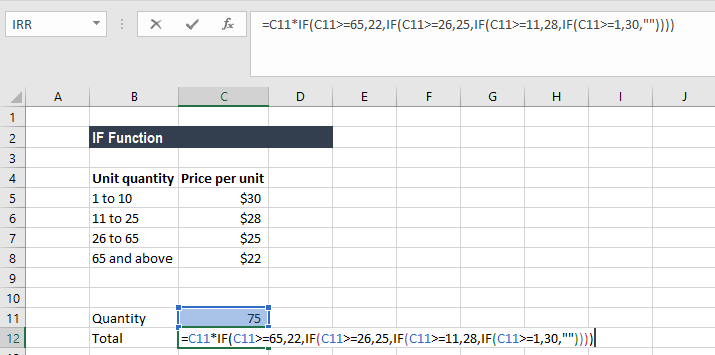

There will always be a value for each day in column A, so I would like to run a macro when the users click save that will check column A for a value. There are a few "complicated" users out there who refuse to enter a zero in the second column if there is no amount for that day, and they leave it blank, causing errors across the worksheet. Every day the Location Manager fills out 2 columns, and the rest are calculated automatically. There are multiple columns, and one row for each day of the month. Keyboard shortcuts speed up your modeling skills and save time.I currently have 12 copies of a Workbook - one for each one of our company's locations.

ITERATE IN EXCEL FOR MAC PC

Excel Shortcuts for PC and Mac Excel Shortcuts PC Mac Excel Shortcuts - List of the most important & common MS Excel shortcuts for PC & Mac users, finance, accounting professions.Advanced Excel Formulas You Must Know Advanced Excel Formulas Must Know These advanced Excel formulas are critical to know and will take your financial analysis skills to the next level.Excel Functions for Finance Excel for Finance This Excel for Finance guide will teach the top 10 formulas and functions you must know to be a great financial analyst in Excel.

To learn more, check out these additional CFI resources: By taking the time to learn and master these functions, you’ll significantly speed up your financial analysis. Thanks for reading CFI’s guide to the Excel XIRR function.

ITERATE IN EXCEL FOR MAC DOWNLOAD

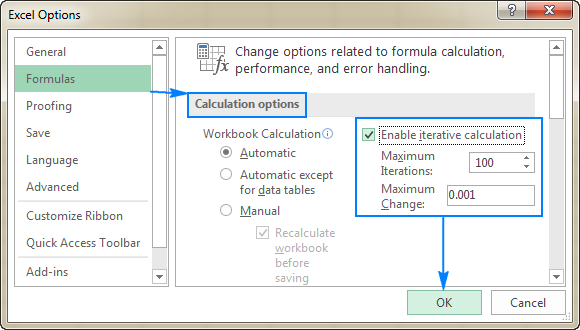

#VALUE! error – Occurs when either of the dates given cannot be recognized by Excel as valid dates.Ĭlick here to download the sample Excel file.The calculation fails to converge after 100 iterations.Any of the given dates precede the first date provided.The given arrays do not contain at least one negative and at least one positive value.The values and dates arrays are of different lengths.Dates should be entered as references to cells containing dates or values returned from Excel formulas.The rate of return calculated by XIRR is the interest rate corresponding to XNPV = 0. Numbers in dates are truncated to integers.Things to remember about the XIRR Function We will leave the guess as blank so Excel takes the default value of 10%. The project gives us cash flows in the middle of the first year, after 6 months, then at the end of 1.5 years, 2 years, 3.5 years, and annually thereafter. Suppose a project started on January 1, 2018. To understand the uses of the XIRR function, let’s consider a few examples: Using a changing rate (starting with ), XIRR cycles through the calculation until the result is accurate within 0.000001%. If omitted, Excel takes the default value of 10%.Įxcel uses an iterative technique for calculating XIRR. (optional argument) – This is an initial guess – or estimate – of what the IRR will be.Subsequent dates should be later than the first date, as the first date is the start date and subsequent dates are future dates of outgoing payments or income.

ITERATE IN EXCEL FOR MAC SERIES

Dates (required argument) – This is a series of dates that correspond to the given values.Instead of an array, it can be a reference to a range of cells containing values.

In financial modeling What is Financial Modeling Financial modeling is performed in Excel to forecast a company's financial performance. XIRR assigns specific dates to each individual cash flow making it more accurate than IRR when building a financial model in Excel. To learn more, read why to always use XIRR over IRR XIRR vs IRR Why use XIRR vs IRR. The main benefit of using the XIRR Excel function is that such unevenly timed cash flows can be accurately modeled. It does this by assigning specific dates to each individual cash flow. for a series of cash flows that may not be periodic. In other words, it is the expected compound annual rate of return that will be earned on a project or investment. It will calculate the Internal Rate of Return (IRR) Internal Rate of Return (IRR) The Internal Rate of Return (IRR) is the discount rate that makes the net present value (NPV) of a project zero. The XIRR function is categorized under Excel financial functions.

0 kommentar(er)

0 kommentar(er)